Australia has one of the world’s largest and most sophisticated managed funds industries, and yet, only a relatively small amount of that capital comes from offshore investors.

This has led the Government to establish a more globally recognisable, sharebased collective investment vehicle, compared to the trust-based Managed Investment Scheme (MIS) we have historically relied on.

This new type of collective investment vehicle is known as the Corporate Collective Investment Vehicle (CCIV) – designed to better attract offshore capital, while also remaining suitable for domestic investors. The following paper provides an overview of what CCIVs are and how they are structured, outlines the benefits of adopting CCIVs, and explains how Polar 993 can be of service.

WHAT IS A CCIV?

The key features of a CCIV are outlined below:

- A CCIV is a company limited by shares

- It is a flow-through tax vehicle company structure, which is effectively treated as a trust for tax

- It has a separate legal personality from its operator

- It is structured as an umbrella investment vehicle with one or more sub-funds

- The sub-funds allow for different investment strategies

- The assets and liabilities of each sub-fund are strictly segregated and quarantined for liability, regulatory and taxation purposes

- Investors hold shares referable to the sub-fund(s) of their choosing

- Income is distributed as dividends, however it is treated and taxed as a distribution from a trust

Unlike a standard company, the CCIV has only one director – the Corporate Director – which must be a public company holding an AFS license authorising it to operate a CCIV. The CCIV itself is not required to hold an AFSL. The operational functions of the CCIV, such as asset management, can be performed by fund managers. A CCIV can be either ‘retail’ or ‘wholesale’.

To see the potential of the CCIV structure, fund managers can look to the success of similar foreign umbrella structures that the CCIV was modelled on:

- UK’s Open-Ended Investment Company (OEIC), commenced in 1997 – approximately 4,000 in operation Singapore’s Variable Capital Company (S-VACC), rolled out in 2020 – approximately 400 already established in the last two years

- Singapore’s Variable Capital Company (S-VACC), rolled out in 2020 – approximately 400 already established in the last two years

Polar 993 is a public company holding an AFSL that authorises it to operate CCIVs and to act as a CCIV Corporate Director.

Polar 993 can assist fund managers to establish a CCIV fund.

REGULATORY FRAMEWORK & STRUCTURE

A wholesale CCIV’s governing document is the company constitution, which is lodged with ASIC upon registration. The Corporate Director must perform the responsibilities conferred on it by the constitution as well as ensure that the CCIV remains compliant with the constitution and the Corporations Act. A wholesale CCIV constitution is only required to have prescribed content outlining the process for modification or replacement of the constitution.

- Upon registration, a CCIV must have at least one sub-fund with at least one member (shareholder) in that sub-fund

- All activities undertaken by a CCIV must be referable to a specific sub-fund

- A sub-fund does not have a separate legal personality – only the CCIV has a legal personality

- Sub-funds’ assets and liabilities are clearly segregated – providing investors with protection against the risk of cross-contamination

- CCIV allows for the flexibility for cross-investment, provided the investing is not circular

- A fund manager can construct a CCIV with the capability of providing exposure to specific asset classes (per each sub-fund) as well as to a diversified portfolio of asset classes (a sub-fund invested in the other sub-funds)

Below is a diagrammatic example of a multiple sub-fund CCIV structure, illustrating where Polar 993, the fund manager and members would fit in, as well as the capacity for cross-investment.

FLEXIBLE & SCALABLE MULTI-CLASS VEHICLE

Although CCIVs can have a single sub-fund, they have been created to function as ideal investment vehicles for multiclass funds – allowing more flexibility and less administrative burden than multi-class trusts in offering multiple investment strategies under one vehicle. From an administrative standpoint, having multiple CCIV sub-funds governed by a constitution can be simpler than creating a separate trust deed for each sub-trust. From a flexibility standpoint, the ease with which cross-investment between sub-funds can be operationalised is highly desirable for fund managers looking to offer both diversified and specific investment options under the same vehicle (such as the diagram above). This kind of simplicity is expected to improve fund managers’ capacity and ability to achieve economies of scale.

Tax Treatment

For the purposes of taxation, a sub-fund is deemed to be a unit trust (a ‘CCIV sub-fund trust’) and sub-fund members are deemed to be beneficiaries, allowing for flow-through taxation treatment (as though directly investing in a subfund’s underlying assets). Therefore, amounts attributed for distribution to members will not be treated as dividends paid by the CCIV – retaining their original source/character and taxed on that basis. The general tax treatment of CCIVs has been intentionally designed to align with the existing Attribution Managed Investment Trust (AMIT) regime.

CCIVs are structured to be internationally competitive, flexible, and scalable umbrella investment vehicles.

CCIVs provide investment managers with less administrative burden for multi-strategy offerings and protect investors against the risk of asset class cross-contamination.

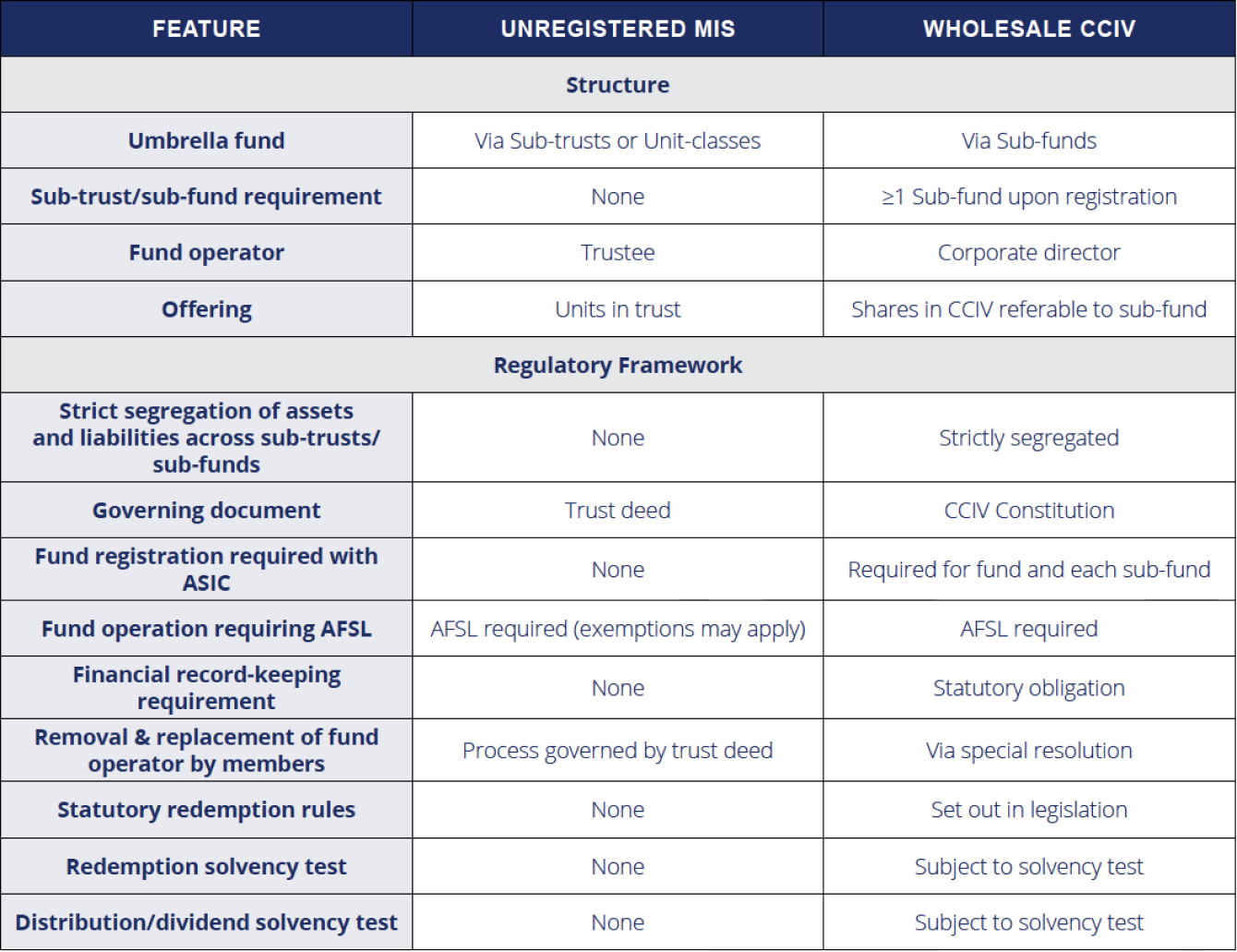

UNREGISTERED MIS VS WHOLESALE CCIV

Polar 993 holds an AFS License authorising it to operate a CCIV. For fund managers looking to establish a CCIV, Polar 993 is able to assist. Our team has in-house legal and accounting expertise to assist fund managers in fund establishment and structuring. If you have any questions about CCIVs or any other fund structures, please do not hesitate to reach out to our team. Polar 993 is also able to assist with the establishment of venture capital funds, limited partnerships, and unit trusts; and provides trustee, AFS licensing, and distribution services.

If you have any questions regarding CCIVs or other fund structures, please do not hesitate to contact us. We are always happy to assist clients in choosing the optimal fund structure.

-

Adam Lindell: 0402 781 850

adam.lindell@polar993.com